estate tax return due date 1041

For calendar-year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 2019. Estate and trust income tax payments and return filings on.

Irs Says Key Tax Forms Will Be Ready For Tax Season But There S No Start Date Yet

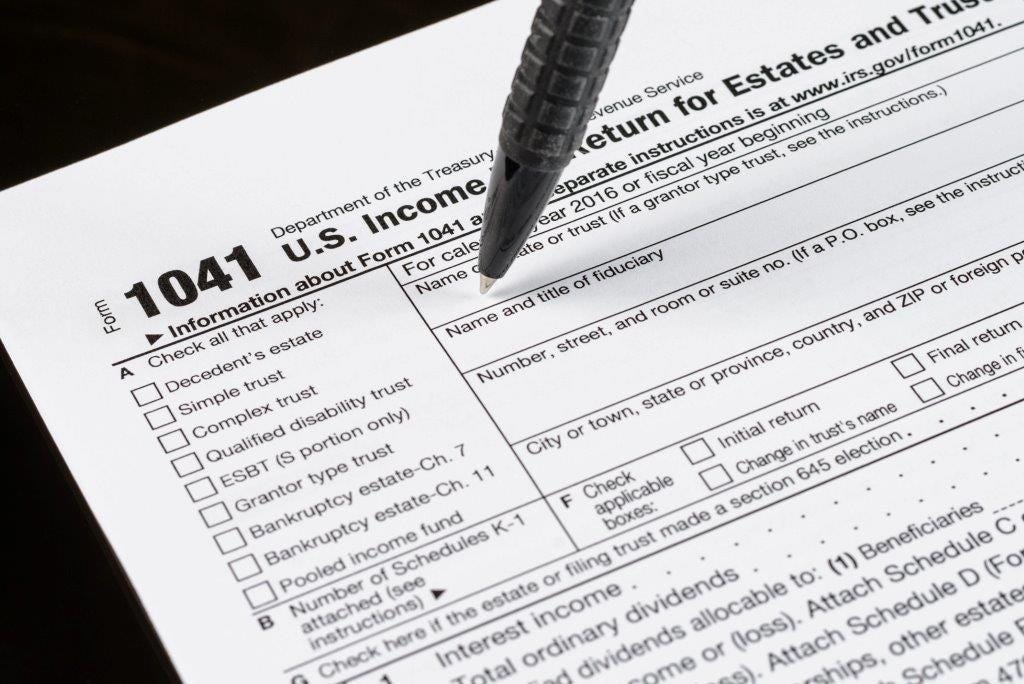

More In File Form 1041.

. Read on to learn the specifics Dont File Form 1041 If Form 1041 is not needed if. For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041. The executor trustee or personal representative of the estate or trust is responsible for filing Form 1041.

For all tax filing deadlines. If the tax year for an estate ends on June 30 2020you must file by October 15 2020. For example for a trust or.

Form 1041 is an IRS tax return used to record income generated by assets held in an estate or trust. 13 rows Only about one in twelve estate income tax returns are due on April 15. In general an estate must pay quarterly estimated income tax in the same manner as individuals.

If no federal estate tax return is required for the decedents estate the federal gift tax return due date is April 15th following the year of the decedents death. One of the following is due nine months after the decedents date of. The due date for filing a 1041 falls on tax day.

Return extension payment due dates. Form 1041 - Return Due Date. For more information on when estimated tax payments are required see.

Estate tax forms rules and information are specific to the date of death. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return. As long as the estate exists a Form 1041 should be filed.

Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. Form 1041 Form 1041-N. Known due dates at this posting are below for the 2021 tax year due in 2022.

For fiscal year estates file Form 1041 by the 15th day of the. Resulting in a Form 1041 due date of April 15 the. The changes usually apply to taxation years beginning after.

2021 Estate Income Tax Calculator Rates

Update In A Bankruptcy Filing Your Tax Return On Time Is Necessary Hinkle Law Firm Llc

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

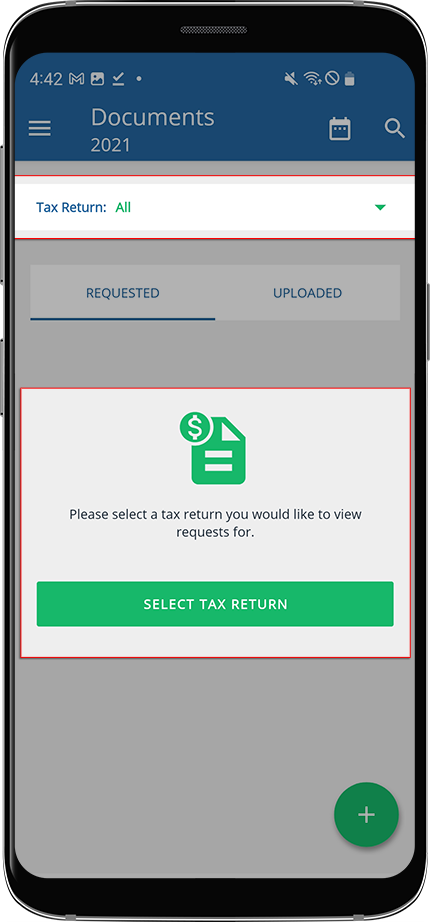

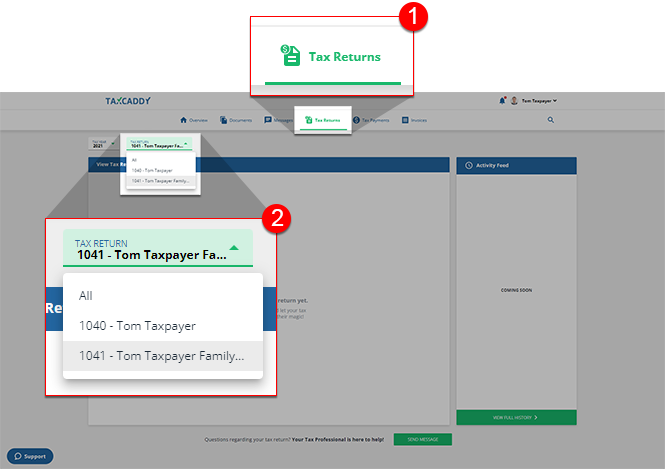

1041 Tax Returns For Trust Or Estate Taxcaddy

2019 Tax Form 1041 Fill Out And Sign Printable Pdf Template Signnow

Fillable Form 1041 Income Tax Return Income Tax Tax Forms

File Form 1041 U S Fiduciary Income Tax Return By Patti Spencer Estategenie Blog

Form 1040 Us Individual Income Tax Return 1040 Pdf Fpdf Docx Official

Us Tax Filling Deadlines And Important Dates Us Tax Law Services

Probate Process Probate Timeline Inheritance Process Probate Timeline Insurance Benefits

File Form 706 Federal Estate Tax Return By Patti Spencer Estategenie Blog

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Esbt And Qsst Elections Castro Co

:max_bytes(150000):strip_icc()/1040-X2021-1f84c7ebdea2461ba2f7d9de9c6cb8ec.jpeg)

/1040-X2021-1f84c7ebdea2461ba2f7d9de9c6cb8ec.jpeg)